Multi-Asset Investment Intelligence Platform

A unified platform where investors can analyze, compare, and act across multiple asset classes — stocks, crypto, and real estate — without being locked into rigid workflows.

The Problem

Modern investors don’t suffer from a lack of data — they suffer from fragmentation. Real estate, stocks, and crypto data live in isolated systems. The real problem was architectural: How do you unify fundamentally different asset classes under one system without turning the platform brittle?

Architectural Challenges

Integrating powerful but complex data sources (Bloomberg, Gemini, BatchData) and keeping everything customizable as investor strategies evolve.

Our Approach

Instead of building a fixed investment app, we treated InvestorsGoneWild as a financial operating system.

1. A One-Stop Shop — Without a Monolith

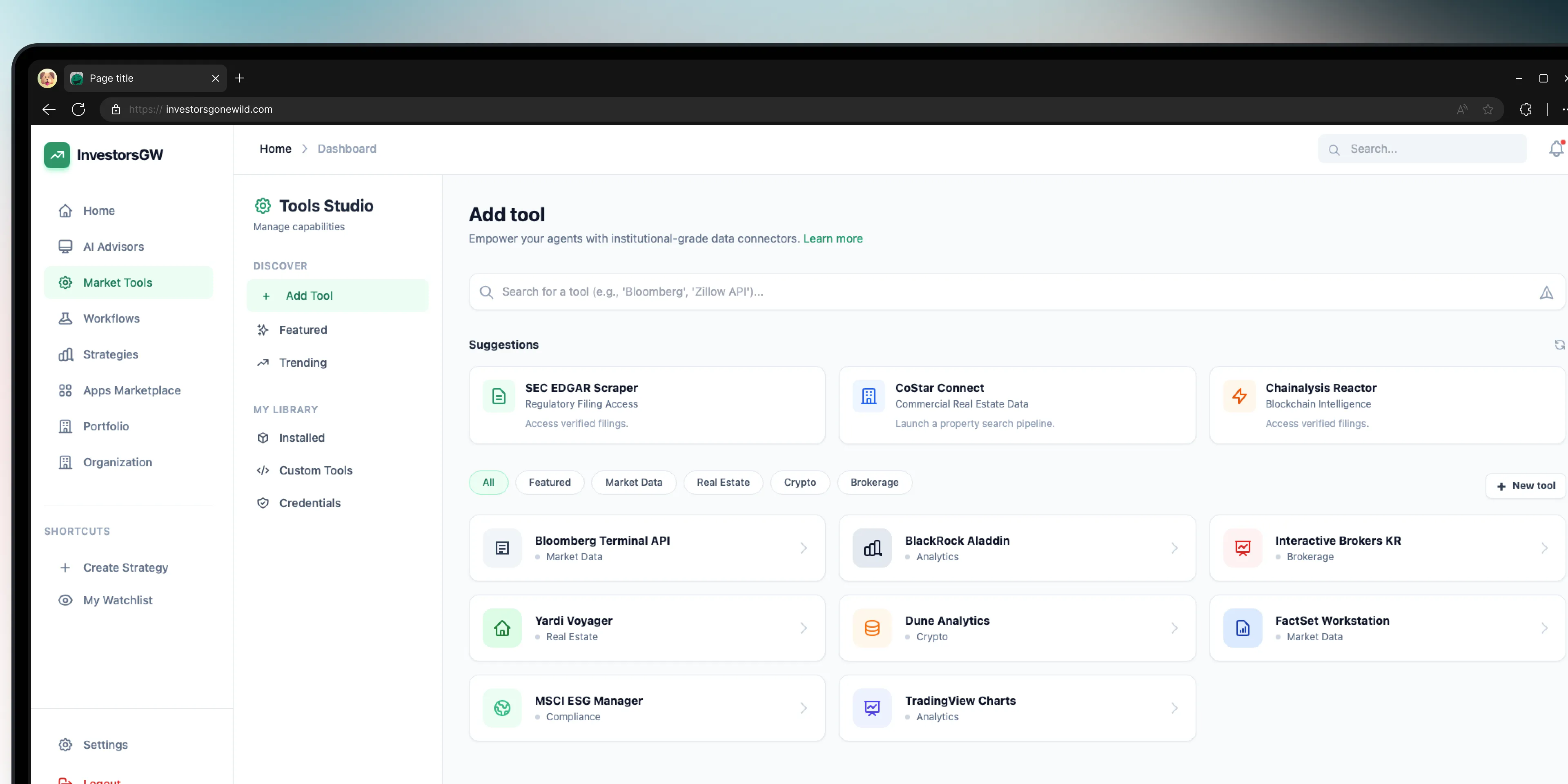

We designed a layered abstraction that allowed each data source to remain independent while still being queryable under a unified experience.

- Stocks & Commodities — market data, performance, trends

- Crypto — volatility-aware analytics and signals

- Real Estate — batch data ingestion and regional insights

2. Integration-First Architecture

Each integration was treated as a data provider, not a dependency. Loosely coupled and replaceable.

- Bloomberg Terminal for market-grade financial data

- Gemini for AI-powered investment recommendations

- BatchData for real estate analytics

3. Metadata-Driven by Design

Inspired by Salesforce, we built a system where entities, fields, and behaviors are defined by metadata, not hard-coded.

- Custom dashboards per investor

- Strategy-specific views without code changes

- Rapid iteration as new asset classes were added

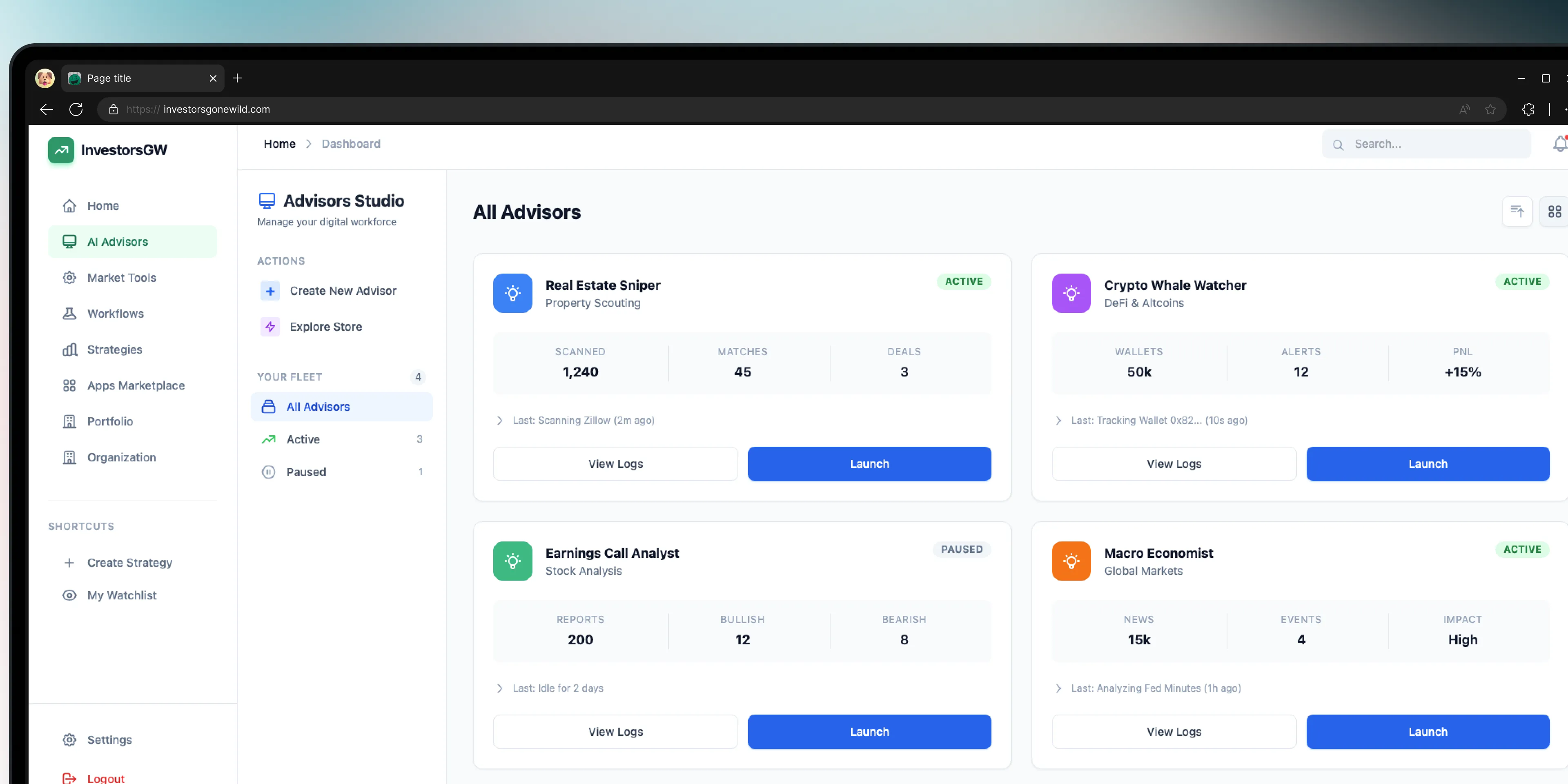

4. Designing for Power Users Without Overwhelm

We focused on progressive disclosure of data and consistent interaction patterns across asset types.

- Progressive disclosure of data

- Clean, CRM-style layouts

- Consistent interaction patterns across asset types

The Outcome

InvestorsGoneWild emerged as a unified investment intelligence platform, not just another portfolio tracker.

Key Achievements

- Multi-asset support under a single system

- Clean separation between data providers and core logic

- Metadata-driven customization inspired by enterprise CRMs

- AI-assisted insights layered on top of trusted data sources

Build Your Dream Team

In Days, Not Months

Stop wasting time on recruitment. Start building your product with elite engineers who care about your success.

No obligation. 100% free technical consultation.